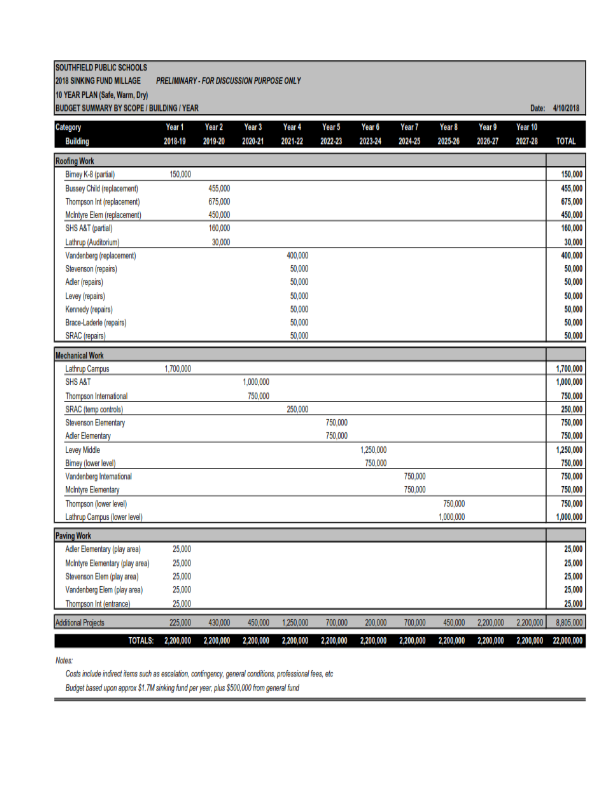

This proposal authorizes the Southfield Public Schools to levy a building and site sinking fund tax, the proceeds of which will be used to make improvements and repairs to the School District’s facilities and to purchase technology. Pursuant to state law, the expenditure of the sinking fund millage proceeds must be audited, and the proceeds cannot be used for teacher, administrator or employee salaries, maintenance or other operating expenses.

Shall the Southfield Public Schools, County of Oakland, Michigan, be authorized to increase the constitutional limitation to allow the levy of 0.7 mill ($0.70 per $1,000 of taxable value) on all taxable property in the district, for a period of ten (10) years, the years 2018 to and including 2027, to create a building and site sinking fund to be used for the construction or repair of school buildings, school security improvements, the acquisition or upgrading of technology or for other purposes, to the extent permitted by law? This millage, if approved and levied, would provide revenues to the School District of approximately $1,681,214 in the first year of levy.