Property Tax Info

Contact Us

A property tax information line is available that allows you to access your tax information, including payment status, over the telephone. The toll-free telephone number for the tax line is (888) 600-3773.

Oakland County Equalization

Is contracted with the City of Lathrup Village to provide property assessment services. Equalization determines Assessed and Taxable Values on properties.

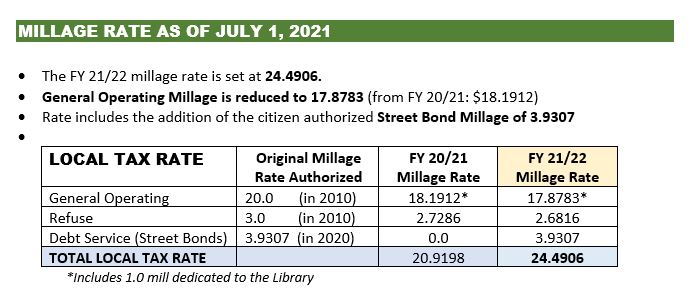

Headlee Rollback

Refers to the passage of the Headlee Amendment in 1978 to Michigan's Constitution. Headlee requires a local unit of government to reduce its millage when annual growth on existing property is greater than the rate of inflation. As a result, a local unit of government's millage rate gets "rolled back" so that the resulting growth in property tax revenue, community-wide, is no more than the rate of inflation.

Taxable value becomes uncapped from property transfers ("pop-ups"). The greater the number of pop-ups, the greater the impact on rollbacks.

Proposal A Brochure for information on:

March Board of Review and Poverty Exemptions

How Property Taxes are calculated

What is Assessed Value

What is State Equalized Value (SEV)

What is "capped value"

How are property values determined

What is a "principal residence exemption"

What is "taxable value"

What happens when you purchase a property